Wheres My Refund.gov

For taxpayers eagerly awaiting their refund, the IRS provides a convenient online tool, "Where's My Refund?" available on the official IRS website, IRS.gov. This service allows individuals to track the status of their tax refund, providing updates on when they can expect to receive their refund. The tool is accessible 24 hours a day, 7 days a week, and can be used to check the status of refunds for the current tax year and the previous two tax years.

How to Use Where’s My Refund?

To use the “Where’s My Refund?” tool, taxpayers will need to provide their Social Security number or Individual Taxpayer Identification Number (ITIN), filing status, and the exact whole dollar amount of their refund. This information can be found on the taxpayer’s tax return. Once this information is entered, the tool will display the status of the refund, including whether it has been received, approved, and sent. If there are any issues with the refund, the tool will provide information on what is causing the delay and what steps the taxpayer can take to resolve the issue.

Refund Status Definitions

The “Where’s My Refund?” tool uses several status definitions to keep taxpayers informed about the progress of their refund. These definitions include:

- Return Received: The IRS has received the taxpayer’s tax return and is processing it.

- Refund Approved: The IRS has approved the taxpayer’s refund and is preparing to send it.

- Refund Sent: The IRS has sent the taxpayer’s refund, either by direct deposit or by mail.

In some cases, the tool may display a message indicating that the refund is being delayed due to additional review or because the taxpayer owes a debt. If this occurs, the taxpayer should follow the instructions provided by the tool to resolve the issue.

| Refund Method | Average Delivery Time |

|---|---|

| Direct Deposit | 8-14 days |

| 6-8 weeks |

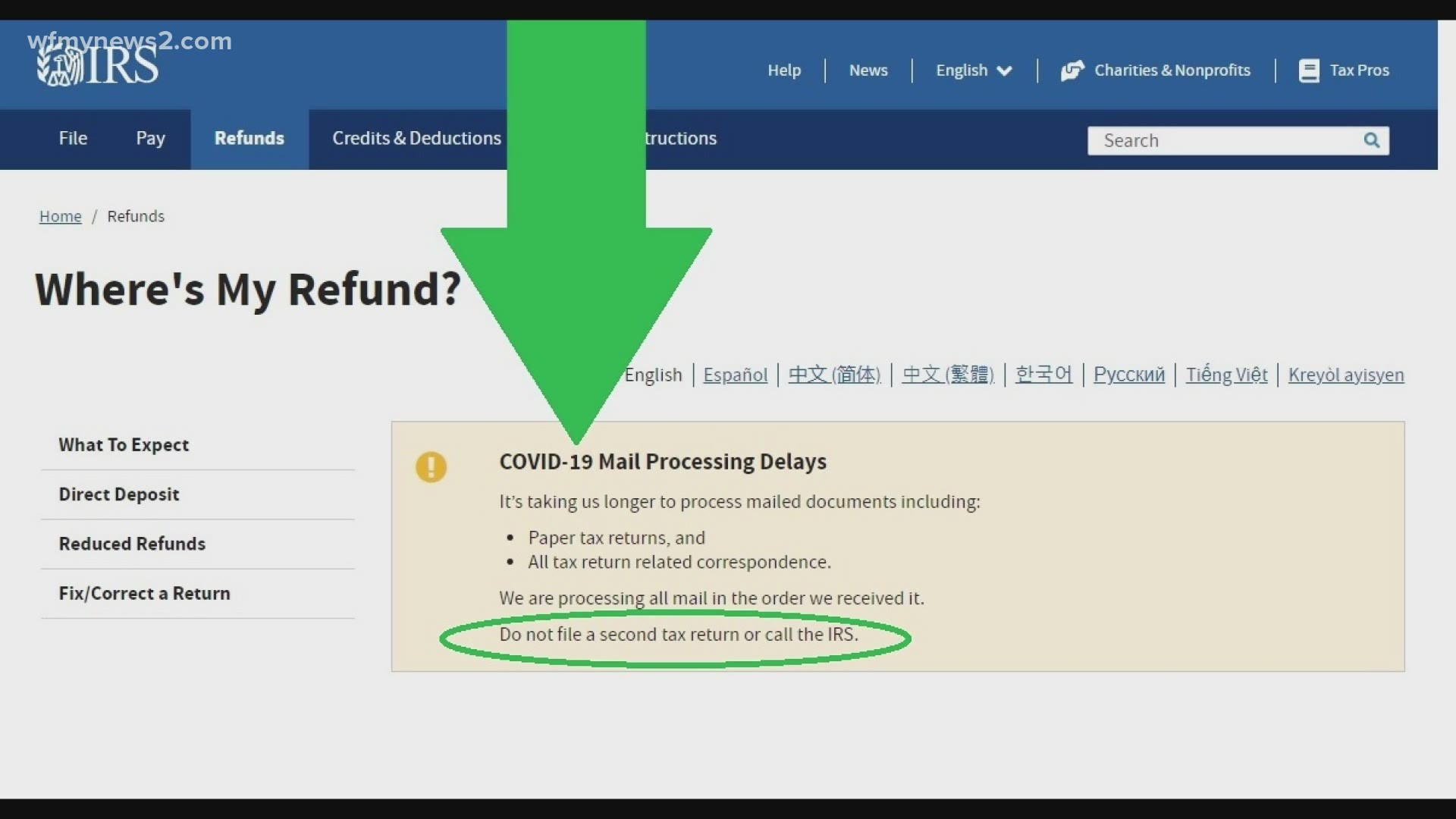

Troubleshooting Refund Issues

If a taxpayer encounters an issue with their refund, there are several steps they can take to resolve the problem. First, they should check the “Where’s My Refund?” tool to see if there are any messages or updates regarding their refund. If the tool indicates that the refund is being delayed due to additional review, the taxpayer should wait until the review is complete before contacting the IRS. If the taxpayer owes a debt, they should follow the instructions provided by the tool to pay the debt and resolve the issue.

Common Refund Issues

Some common issues that can cause delays in refunds include:

- Incomplete or inaccurate tax returns: If a taxpayer’s tax return is incomplete or contains errors, it may delay the processing of their refund.

- Identity theft: If the IRS suspects that a taxpayer’s identity has been stolen, they may delay the refund until the issue is resolved.

- Debts owed to the government: If a taxpayer owes a debt to the government, such as back taxes or child support, the IRS may withhold their refund until the debt is paid.

Taxpayers who encounter any of these issues should follow the instructions provided by the “Where’s My Refund?” tool to resolve the problem and receive their refund.

What is the “Where’s My Refund?” tool?

+The “Where’s My Refund?” tool is a service provided by the IRS that allows taxpayers to track the status of their tax refund.

How do I use the “Where’s My Refund?” tool?

+To use the “Where’s My Refund?” tool, taxpayers need to provide their Social Security number or ITIN, filing status, and the exact whole dollar amount of their refund.

What if my refund is delayed?

+If a taxpayer’s refund is delayed, they should check the “Where’s My Refund?” tool for updates and follow the instructions provided to resolve the issue.