When Are Employees Exempt Vs Non Exempt? Know Rules

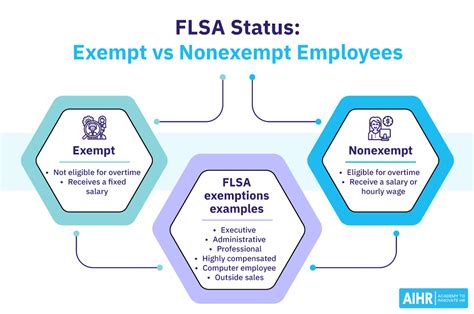

Understanding the difference between exempt and non-exempt employees is crucial for businesses to comply with labor laws and regulations. The Fair Labor Standards Act (FLSA) sets the standards for employee classification, and it's essential to know the rules to avoid misclassification and potential penalties. In this article, we will delve into the details of exempt and non-exempt employees, the rules that govern their classification, and the implications for businesses.

Exempt Employees: Who Are They?

Exempt employees are those who are exempt from the FLSA’s overtime pay provisions and other regulations. To be considered exempt, an employee must meet specific criteria, which include being paid on a salary basis, earning a minimum salary threshold, and performing certain job duties. Executive, administrative, and professional employees are typically exempt, as well as computer professionals, outside sales employees, and highly compensated employees. These employees are not entitled to overtime pay, and their employers are not required to keep track of their working hours.

Executive Exemption

The executive exemption applies to employees who are responsible for managing the organization or a department. To qualify for this exemption, an employee must customarily and regularly direct the work of at least two full-time employees, have the authority to hire and fire employees, and have a significant impact on the organization’s operations. Examples of executive exempt employees include CEOs, department managers, and supervisors.

Administrative Exemption

The administrative exemption applies to employees who perform non-manual work related to the management of the organization. To qualify for this exemption, an employee must customarily and regularly exercise discretion and independent judgment, and their work must be directly related to the management of the organization. Examples of administrative exempt employees include human resources managers, financial analysts, and marketing directors.

Professional Exemption

The professional exemption applies to employees who perform work that requires advanced knowledge in a field of science or learning. To qualify for this exemption, an employee must customarily and regularly exercise discretion and independent judgment, and their work must be intellectual in nature. Examples of professional exempt employees include doctors, lawyers, and engineers.

| Exemption Category | Job Duties | Salary Threshold |

|---|---|---|

| Executive | Manage the organization or department, direct the work of at least two full-time employees | $684 per week |

| Administrative | Perform non-manual work related to the management of the organization, exercise discretion and independent judgment | $684 per week |

| Professional | Perform work that requires advanced knowledge in a field of science or learning, exercise discretion and independent judgment | $684 per week |

Non-Exempt Employees: Who Are They?

Non-exempt employees are those who are entitled to overtime pay and other protections under the FLSA. Hourly employees, manual laborers, and service industry workers are typically non-exempt. These employees must be paid at least the minimum wage, and their employers must keep track of their working hours to ensure compliance with overtime pay regulations.

Overtime Pay

Non-exempt employees are entitled to overtime pay if they work more than 40 hours in a workweek. Overtime pay is calculated as 1.5 times the employee’s regular rate of pay, and it must be paid for all hours worked over 40. For example, if an employee earns 15 per hour and works 45 hours in a week, they would be entitled to 22.50 per hour for the 5 hours of overtime worked.

Minimum Wage

Non-exempt employees must be paid at least the minimum wage, which is currently $7.25 per hour. However, some states and cities have higher minimum wage rates, and employers must comply with the highest applicable rate.

| Non-Exempt Category | Job Duties | Pay Requirements |

|---|---|---|

| Hourly Employees | Perform manual labor, work in the service industry | Minimum wage, overtime pay for hours worked over 40 |

| Manual Laborers | Perform physical work, such as construction or manufacturing | Minimum wage, overtime pay for hours worked over 40 |

| Service Industry Workers | Work in the service industry, such as restaurants or hotels | Minimum wage, overtime pay for hours worked over 40 |

Implications for Businesses

Classifying employees as exempt or non-exempt has significant implications for businesses. Misclassification can result in penalties, fines, and lawsuits, so it’s essential to understand the rules and regulations. Employers must also ensure that they are complying with overtime pay regulations, minimum wage laws, and other labor standards.

Compliance Strategies

To ensure compliance, businesses should regularly review their employee classifications and update them as necessary. Employers should also train their managers and supervisors on the rules and regulations, and keep accurate records of employee working hours and pay.

What is the difference between exempt and non-exempt employees?

+Exempt employees are those who are exempt from the FLSA’s overtime pay provisions and other regulations, while non-exempt employees are entitled to overtime pay and other protections under the FLSA.

How do I determine if an employee is exempt or non-exempt?

+To determine if an employee is exempt or non-exempt, you must consider their job duties, salary, and other factors. You can use the FLSA’s exemption categories, such as executive, administrative, and professional, to guide your decision.

What are the penalties for misclassifying employees?

+Misclassifying employees can result in penalties, fines, and lawsuits. Employers may be required to pay back wages, overtime pay, and other damages to affected employees.