Florida Revenue Guide: Tax Answers

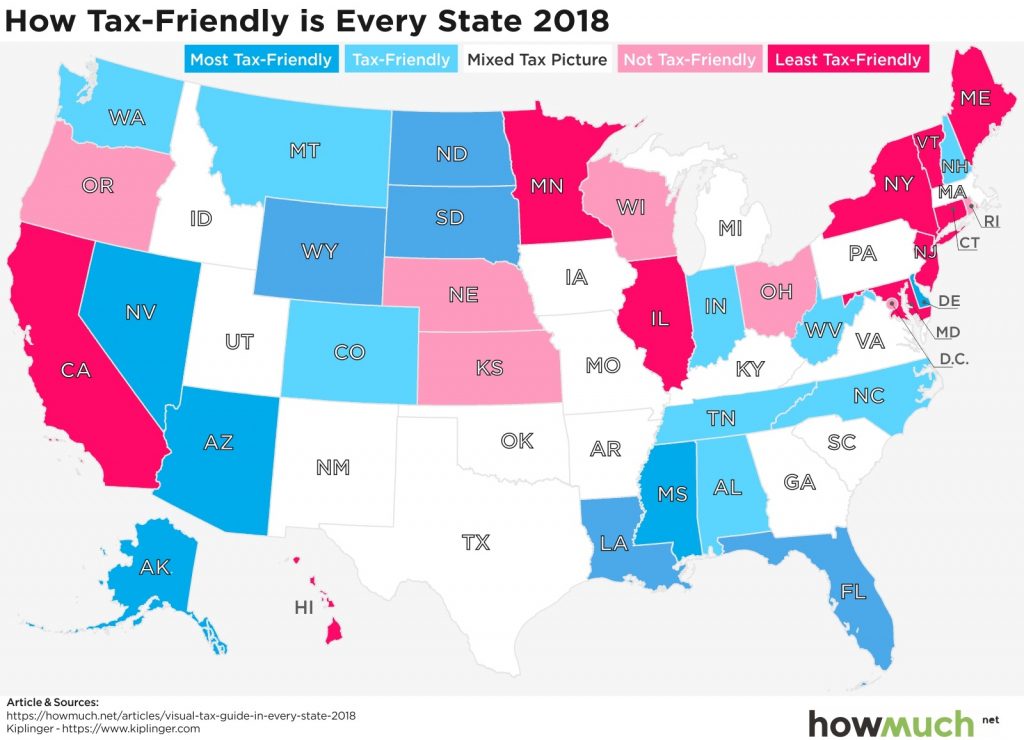

Florida, known as the Sunshine State, is a hub for businesses and individuals alike, thanks to its favorable climate and tax environment. Understanding the tax landscape in Florida is crucial for anyone looking to start or maintain a business, invest, or simply reside in the state. This guide aims to provide comprehensive insights into Florida's revenue and tax system, offering answers to common questions and shedding light on the intricacies of the state's tax policies.

Introduction to Florida’s Tax System

Florida’s tax system is designed to be relatively business-friendly, with no state income tax, which makes it an attractive location for individuals and corporations seeking to minimize their tax liability. However, like all states, Florida has its own set of taxes and revenue generation methods. The state relies heavily on sales tax, property taxes, and various fees to fund its operations and provide public services.

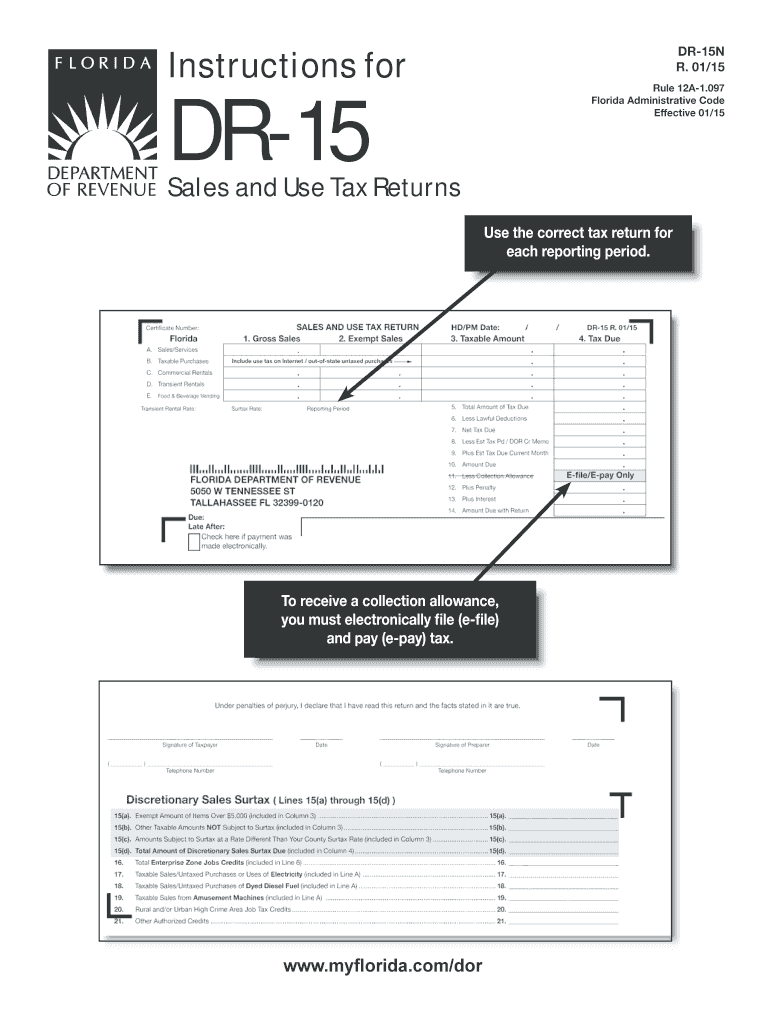

Understanding Sales Tax in Florida

The sales tax in Florida is a key component of the state’s revenue. With a base rate of 6%, Florida’s sales tax applies to the sale of tangible personal property and certain services. Local governments can also impose an additional sales tax, known as the discretionary sales surtax, which ranges from 0.1% to 1.5% depending on the jurisdiction. Businesses operating in Florida must understand their obligations regarding sales tax collection and remittance to avoid penalties and ensure compliance with state regulations.

One of the critical aspects of sales tax in Florida is the concept of nexus, which refers to the connection or presence a business must have in the state to be required to collect and remit sales tax. This includes physical presence, such as having a store or warehouse, and economic nexus, which can be triggered by exceeding certain sales thresholds within the state.

| Tax Type | Rate | Description |

|---|---|---|

| State Sales Tax | 6% | Applies to the sale of tangible personal property and certain services. |

| Discretionary Sales Surtax | 0.1% - 1.5% | Imposed by local governments, varies by jurisdiction. |

Property Taxes in Florida

Property taxes are another significant source of revenue for Florida. These taxes are assessed on real estate and tangible personal property. The state provides several exemptions and deductions, including the homestead exemption, which can significantly reduce the property tax liability for eligible homeowners. Property owners should be aware of the assessment process and the deadline for appealing assessments if they believe their property has been overvalued.

Florida’s Homestead Exemption

The homestead exemption is a valuable tax benefit for Florida residents who own and occupy their homes as their primary residences. This exemption can reduce the taxable value of the property by up to $50,000, thereby lowering the property tax bill. To qualify, applicants must submit their application by March 1st of the tax year for which they are applying, and they must have made the property their permanent residence as of January 1st of that year.

Florida also offers additional exemptions for certain groups, such as veterans with disabilities and seniors, further highlighting the state's effort to provide tax relief to its most vulnerable populations. Eligible property owners should explore these options to maximize their tax savings.

Other Taxes and Fees in Florida

Beyond sales and property taxes, Florida imposes various other taxes and fees to generate revenue. These include documentary stamp taxes on deeds and other documents, intangible taxes on investments and securities, and numerous fees for licenses, permits, and services provided by the state. Businesses and individuals must be aware of these obligations to ensure full compliance with state tax laws.

Taxes on Intangible Property

Florida’s tax on intangible property applies to investments and securities, such as stocks, bonds, and mutual funds. However, the state has reduced the tax rate over the years, making it more attractive for investors. Understanding the current rate and any potential exemptions or deductions is crucial for minimizing tax liability on intangible property.

In conclusion, navigating Florida's tax system requires a deep understanding of the various taxes, exemptions, and compliance requirements. By staying informed and seeking professional advice when necessary, individuals and businesses can optimize their tax strategies, ensure compliance, and take full advantage of the state's favorable tax environment.

What is the sales tax rate in Florida?

+The base sales tax rate in Florida is 6%, with the option for local governments to impose an additional discretionary sales surtax ranging from 0.1% to 1.5%.

How does the homestead exemption work in Florida?

+The homestead exemption in Florida reduces the taxable value of a primary residence by up to $50,000, provided the owner applies by March 1st and has made the property their permanent residence as of January 1st of the tax year.

Are there any other significant taxes or fees in Florida besides sales and property taxes?

+Yes, Florida imposes documentary stamp taxes, intangible taxes, and various fees for licenses, permits, and services. Understanding these taxes and fees is important for full compliance with state tax laws.